Allstate Insurance Company: A Comprehensive Review of Customer Experiences and Services

Allstate Insurance Company is one of the largest insurance providers in the United States, offering a wide range of insurance products including auto, home, life, and renters insurance. This comprehensive review examines customer experiences, service quality, policy options, pricing, and the overall value proposition Allstate provides. We will analyze both positive and negative feedback from various sources to provide a balanced perspective.

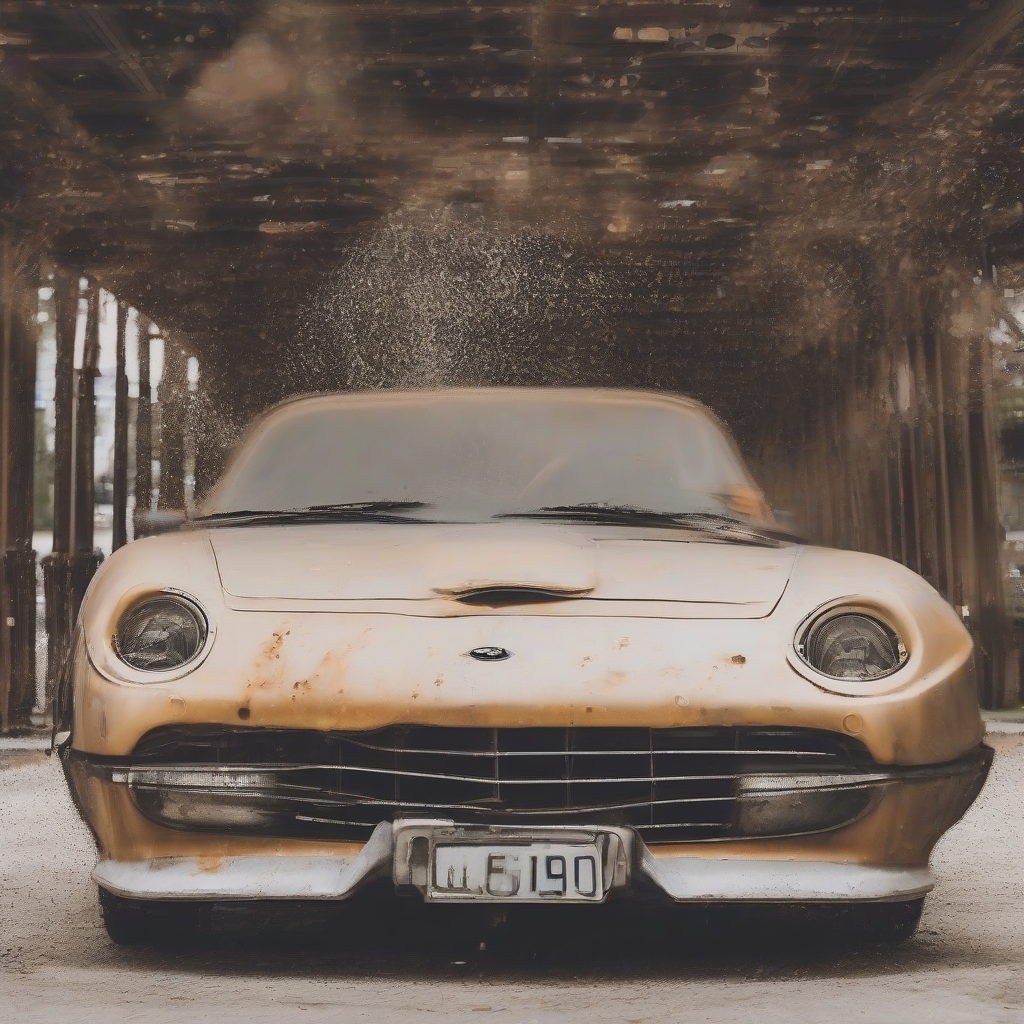

Auto Insurance

Allstate’s auto insurance is a popular choice for many, but its performance varies depending on individual experiences. Customer reviews highlight both positive and negative aspects:

- Positive Aspects: Many customers praise Allstate’s strong claims handling process, reporting relatively quick and efficient payouts. The availability of various discounts, such as good driver discounts, multiple policy discounts, and safe-driver programs, is also frequently cited as a positive. The company’s widespread network of repair shops can also streamline the repair process after an accident.

- Negative Aspects: Some customers complain about the difficulty of reaching customer service representatives, citing long wait times and unhelpful agents. Price competitiveness is another area of concern, with some finding Allstate’s premiums higher than competing insurers. Certain policy limitations and exclusions have also been sources of frustration for some policyholders.

Home Insurance

Allstate’s home insurance offerings mirror the mixed feedback seen in its auto insurance segment. Key aspects include:

- Positive Aspects: Similar to auto insurance, the claims process often receives positive reviews for its efficiency and responsiveness. The availability of various coverage options, allowing homeowners to customize their policies to their specific needs, is a significant advantage. Many customers appreciate Allstate’s proactive approach to risk mitigation, such as offering discounts for home security systems.

- Negative Aspects: Pricing remains a point of contention for some customers, especially in areas with high property values or risk profiles. The complexity of certain policy documents and the difficulty of understanding coverage limitations can be frustrating for some homeowners. Delays in claim settlements, though less frequent than positive experiences, are also reported by a segment of customers.

Life Insurance

Allstate’s life insurance products offer various options to suit different financial goals and risk tolerances. The review of customer experience in this area reveals:

- Positive Aspects: Customers often praise the clarity and simplicity of Allstate’s life insurance policies, making it easier to understand coverage and benefits. The availability of term life insurance and whole life insurance options allows for flexibility in choosing a policy that aligns with individual needs. The online tools and resources provided by Allstate can simplify the process of obtaining quotes and applying for coverage.

- Negative Aspects: Some customers find the application process lengthy and complex, particularly for those seeking more specialized life insurance policies. The cost of Allstate’s life insurance policies is a factor that influences customer satisfaction, with some finding premiums higher than those offered by competitors. The limited availability of certain life insurance products in specific regions can be a drawback for some potential customers.

Renters Insurance

Allstate also provides renters insurance, a crucial coverage for those renting apartments or homes. Here’s what customer reviews suggest:

- Positive Aspects: The relatively affordable premiums are often highlighted as a significant advantage of Allstate’s renters insurance. The ease of obtaining coverage, both online and through agents, is another frequently mentioned positive. The comprehensive coverage offered, protecting renters against various losses, provides peace of mind.

- Negative Aspects: Some customers express dissatisfaction with the claims process, reporting delays or difficulties in obtaining compensation. The lack of personalized attention and limited interaction with human agents can be a drawback for some customers who prefer a more personal approach. The specific coverage limits and exclusions can be a source of frustration for some renters.

Customer Service

Customer service is a crucial aspect of any insurance company’s performance. Allstate’s customer service receives mixed reviews:

- Positive Aspects: Some customers report positive experiences with Allstate’s customer service representatives, praising their helpfulness, professionalism, and responsiveness. The availability of multiple customer service channels, including phone, email, and online chat, enhances convenience.

- Negative Aspects: Long wait times and difficulty reaching a live agent are common complaints. Inconsistent levels of service quality, with some customers reporting positive experiences while others describe negative interactions, highlight the need for improved service standardization. The complexity of navigating Allstate’s online customer service portal is another frequent criticism.

Pricing and Value

The cost of Allstate’s insurance policies is a key factor influencing customer satisfaction. A comprehensive assessment reveals:

- Positive Aspects: Allstate frequently offers various discounts that can significantly reduce premiums. The availability of bundled policies for auto and home insurance can result in cost savings for customers. The potential for long-term savings through loyalty programs and discounts further enhances the value proposition.

- Negative Aspects: Many customers find Allstate’s premiums higher than those offered by competing insurers. The lack of transparency in pricing and the difficulty of comparing quotes with competitors can make it challenging for customers to assess the true value of Allstate’s policies. The absence of personalized pricing, based on individual risk profiles, can lead to feelings of overpayment for some customers.

Overall Assessment

Allstate Insurance Company offers a range of insurance products with both strengths and weaknesses. While many customers appreciate the company’s claims handling process and the availability of various discounts, concerns remain regarding customer service responsiveness, pricing competitiveness, and the clarity of policy documents. Potential customers should carefully compare Allstate’s offerings with those of competing insurers, considering their individual needs and risk profiles before making a decision.

It’s crucial to remember that individual experiences can vary significantly. This review summarizes common themes and trends found in customer reviews and should not be considered a definitive judgment on Allstate’s performance. Potential policyholders are strongly encouraged to conduct their own research and compare quotes from multiple insurers before selecting a provider.